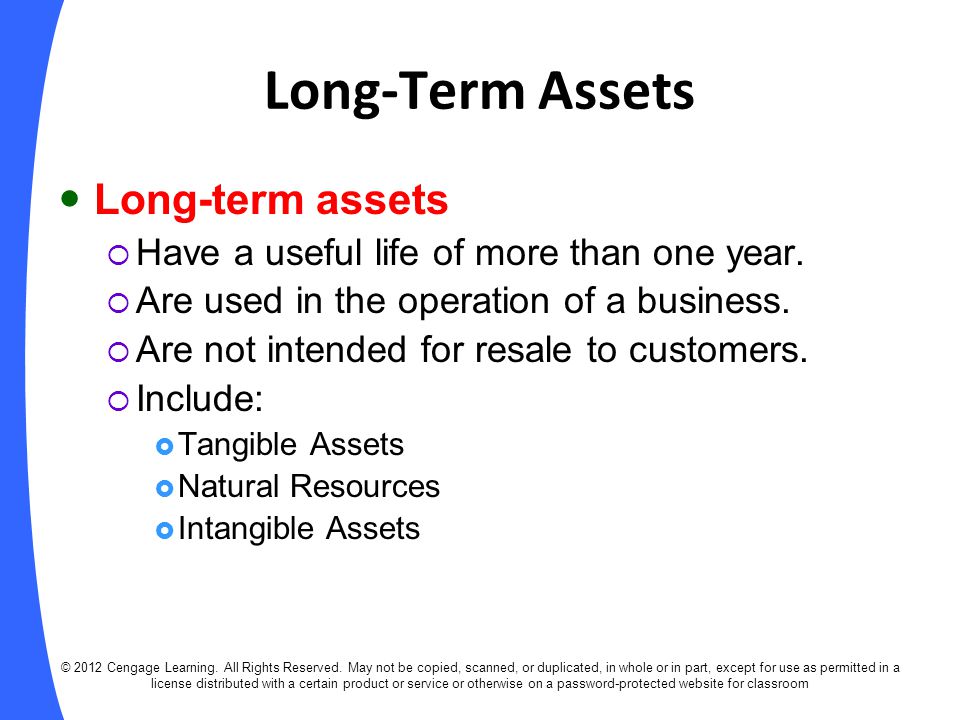

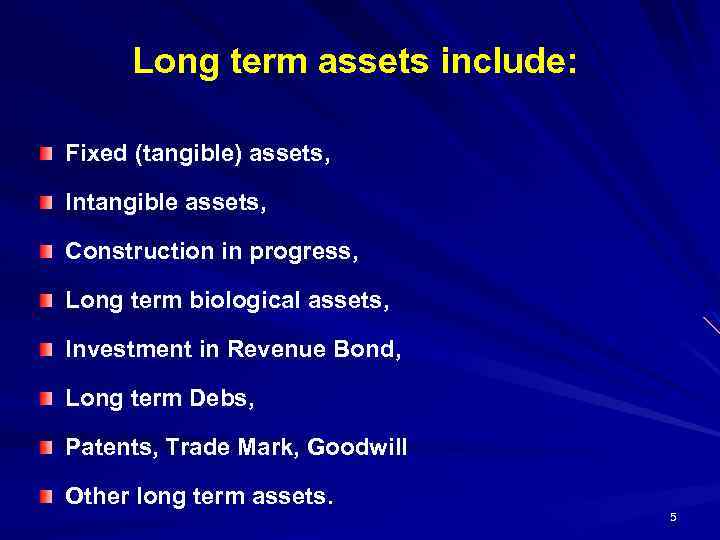

42 long-term tangible assets include

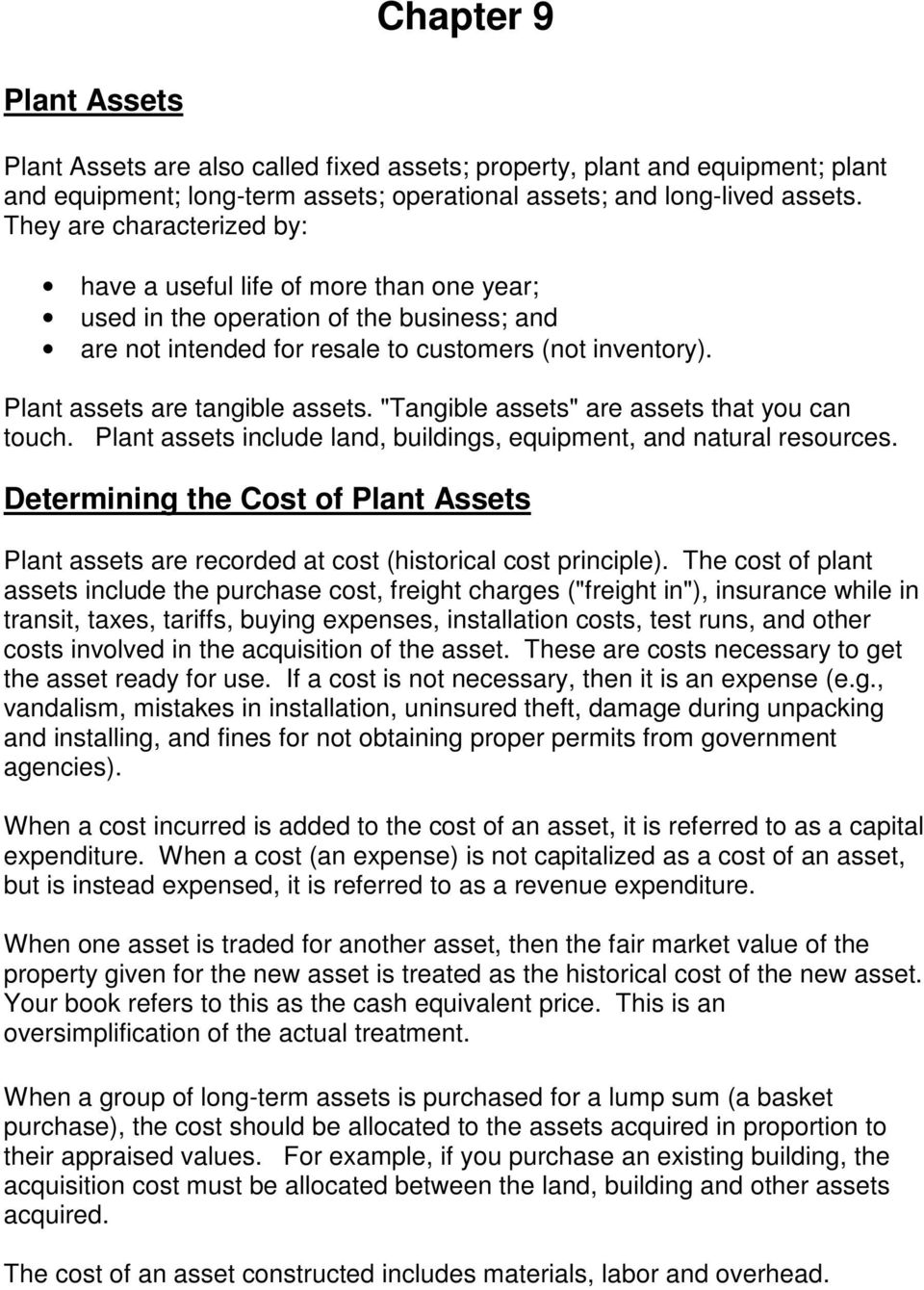

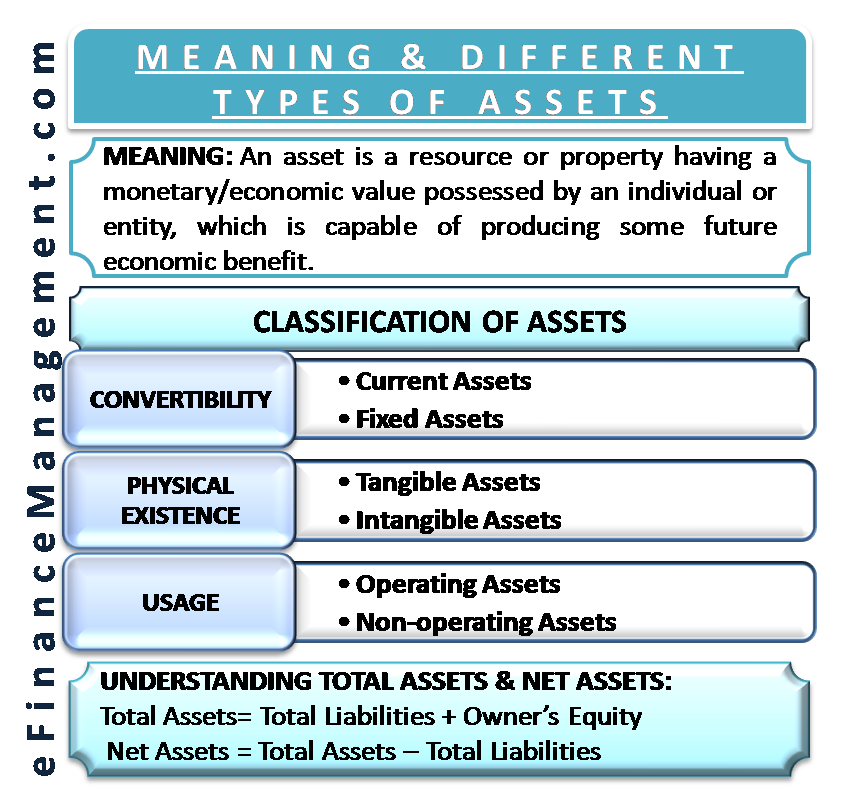

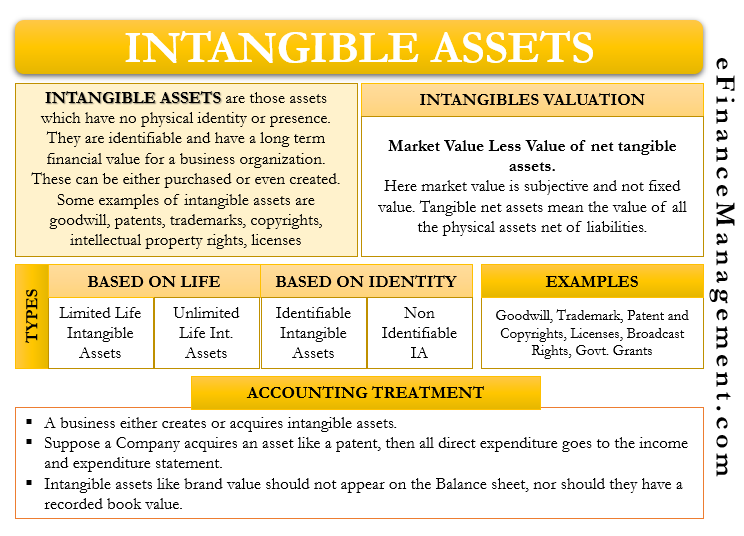

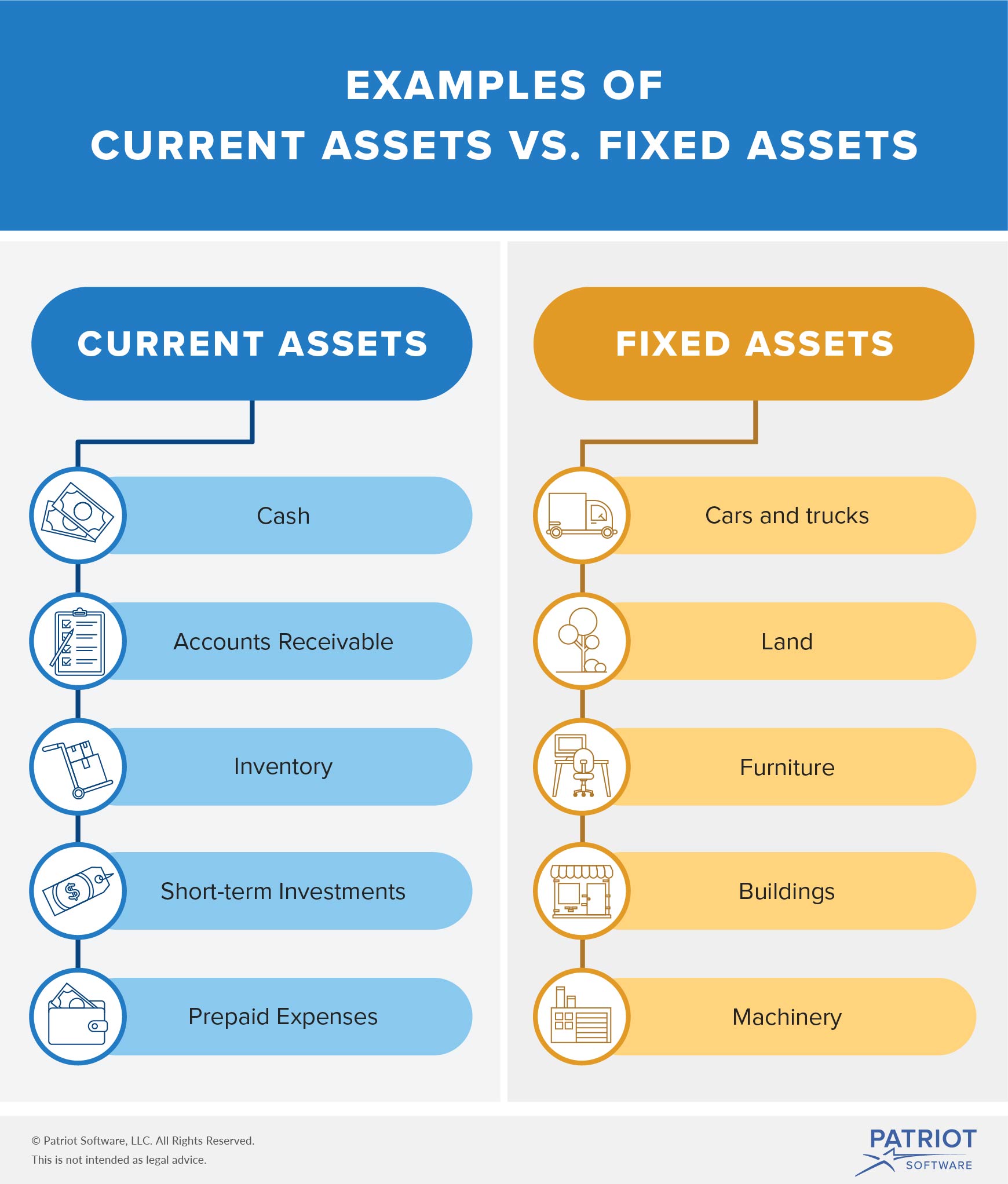

Tangible Assets - Meaning, Importance, Accounting and More Tangible assets can either be current or long-term. Some existing hard assets may lack a physical onsite presence. However, such assets do have a definite The cost price of these assets doesn't just include the purchase price but additional charges as well, such as transportation, insurance and more. What are tangible and intangible assets | BDC.ca Tangible assets are physical; they include cash, inventory, vehicles, equipment, buildings and investments. Intangible assets do not exist in To understand the value of an asset, it's important to understand its potential long-term benefits. Often, intangible assets are of greater long-term value...

› legal-encyclopedia › free-booksWhat Property to Put in a Living Trust - Nolo A living trust isn't the only way to save money on probate. For some assets, you may decide to use other probate-avoidance devices instead. And even if some property does have to go through regular probate, attorney and appraisal fees generally correspond roughly to the value of the probated property, so the cost will be relatively low.

Long-term tangible assets include

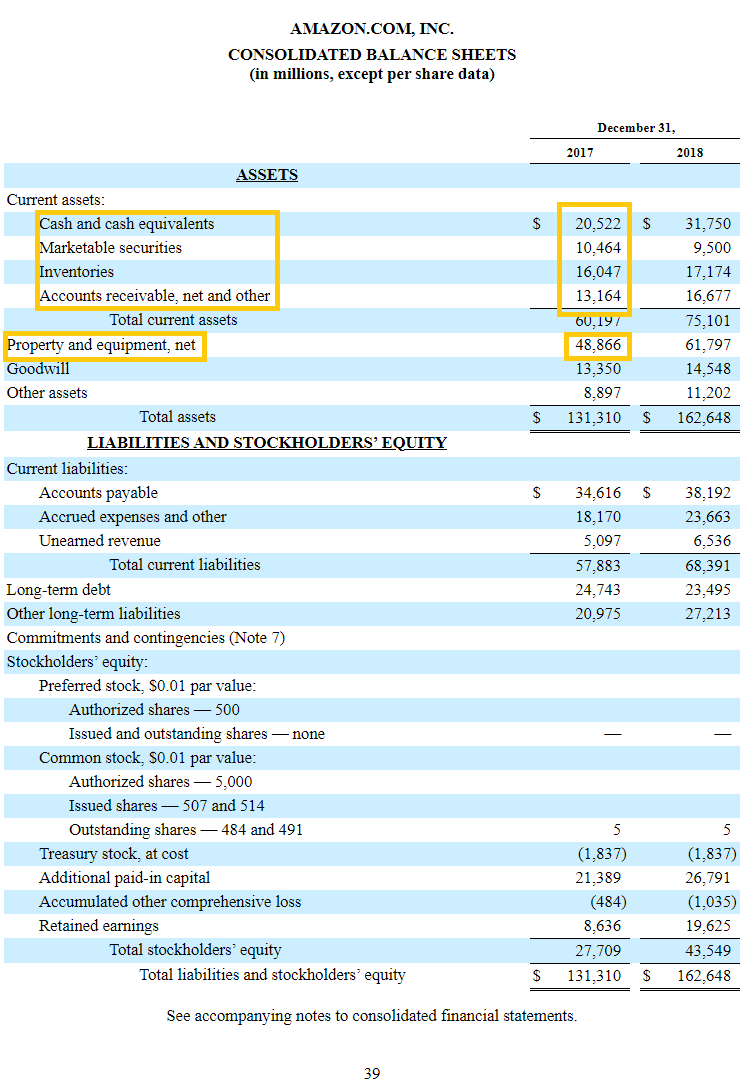

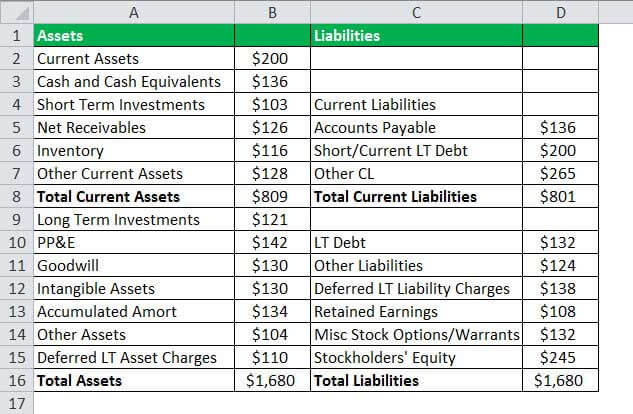

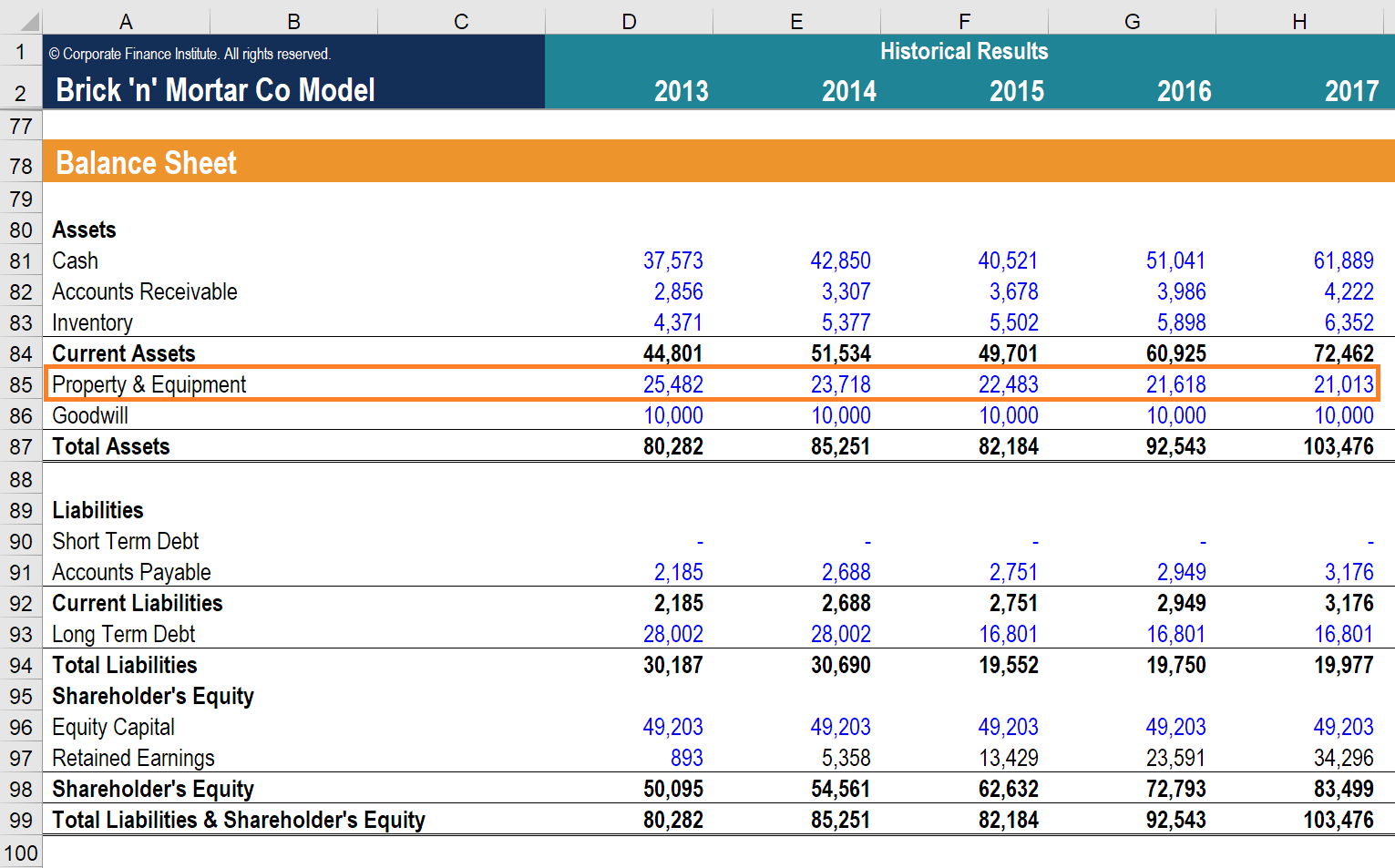

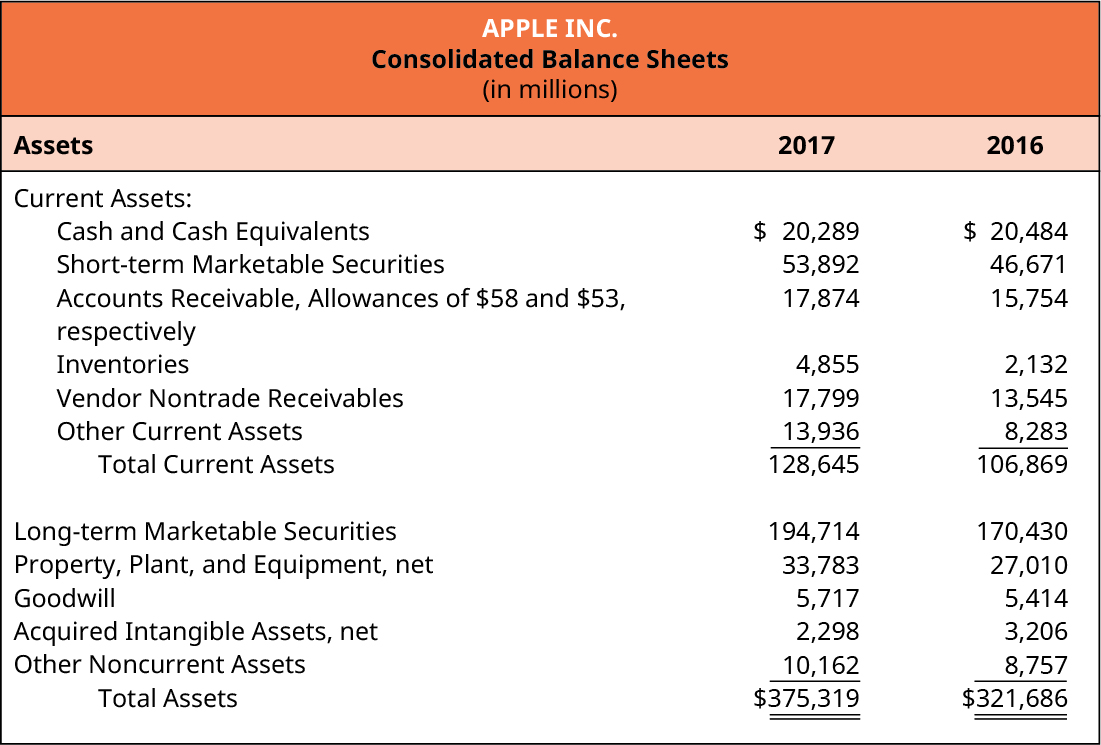

› balance-sheet-newBalance Sheet - Long-Term Assets | AccountingCoach Intangible assets; Other assets; Here is the long-term (or noncurrent) asset section from our sample balance sheets: Investments. The first long-term asset Investments will include amounts such as the following: Long-term investments in investment securities, real estate, or other businesses; Property that is in the process of being sold simplicable.com › new › asset5 Types of Asset - Simplicable Sep 06, 2015 · 1. Tangible Assets Tangible assets are any assets that have a physical presence. Examples include cash, stocks, bonds, property, buildings, equipment, inventory, precious metals and art. How to calculate tangible assets value | GoCardless Tangible assets examples include things like factory equipment, company vehicles, and office supplies. Computers and other electronics also qualify as tangible assets, as does any Intangible assets are considered long-term rather than current. How to calculate the value of tangible assets.

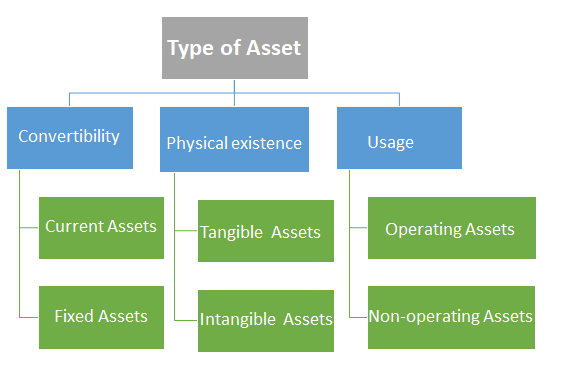

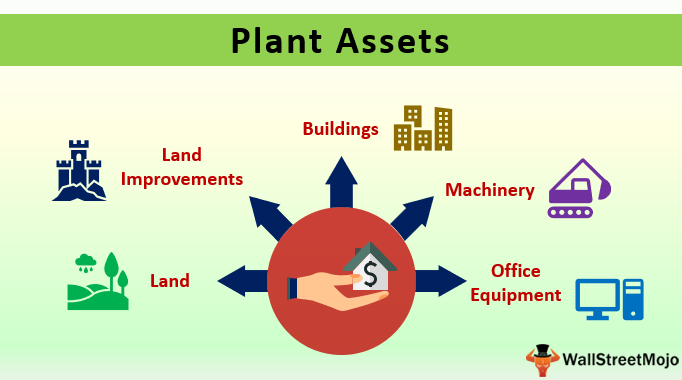

Long-term tangible assets include. How to Use Net Tangible Assets from a Company's Balance Sheet Examples of Tangible Assets include: Equipment. Real Estate. Long Term Investments. Inventory. All of the company's current assets are tangible, so they will be included in our Net Tangible Assets calculation. Like mentioned earlier, Property and equipment is an obvious tangible asset and will also... Tangible Assets (Definition, Examples, List) | How to Value? Tangible Assets are defined as any physical assets owned by a company that can be quantified with relative ease and are used to carry out its business operations. These can include any kind of physical properties such as a piece of land that might be owned by a company along with any structure built... Main Differences Between Short Term and Long Term Assets Since long-term assets are to provide long-term benefits to the business hence, their cost is Long-term assets are classified into the property, plant and equipment, trademarks, client lists They are generally tangible by nature. Fixed Assets can be classified as tangible as well as intangible. Tangible vs Intangible | Top 8 Best Differences (With Infographics) Any tangible assets are assets that have physical existence and physical property; it can be touched—tangible assets mostly associated with fixed assets. Examples of tangible assets include Land, Building, Machinery, Equipment, Cash, Stock, Plant, any property that has long term physical...

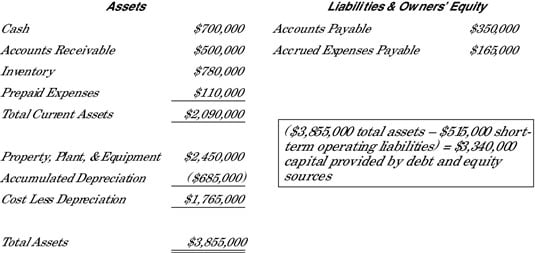

Current vs long-term tangible assets | IG UK Long-term tangible assets, also called fixed assets, are those that will not be turned into cash within one year. This means their value will depreciate, and They include the brand name and intellectual property. Intangible assets cannot be converted into cash, but they do contribute to sales and revenue. Analysis of tangible and intangible project management assets Tangible and intangible assets constitute independent (exogenous) variables that are correlated. In the model, the VRIO characteristics are endogenous Knowledge sharing emerged as a strong factor, both in terms of codified practices and tacit knowledge. We discovered that sharing of project... Tangible Assets - Learn How to Classify and Value Tangible Assets Tangible assets are assets with a physical form and that hold value. Examples include property, plant, and equipment. The liquidity of current assets is significantly greater than that of fixed assetsMonetary AssetsMonetary assets carry a fixed value in terms of currency units (e.g., dollars... (b) Tangible Current Assets Tangible fixed assets include long-term assets which render services beyond one accounting period. They are bought with the purpose not to sell. As a component of current assets these include absolute liquid securities which can be disposed off as and when required.

Ch.6 Long Term Assets Flashcards | Quizlet Long term tangible assets used in the operation of the business such as machinery, equipment, buildings, and vehicles Includes long Consists of PPE - Property, plant and equipment All long term tangible assets assets (except land) become less useful as they are used/aged Cost of all tangible... What is a long-term asset? | AccountingCoach Definition of Long-term Asset A long-term asset is an asset that is not expected to be converted to cash or be consumed within one year of the date shown in Long-term investments. These include some investments in stocks and bonds of other corporations, a company's bond sinking fund, the cash... Tangible assets definition | Capital.com | Related Terms On the other hand, long-term assets, also known as fixed assets, are resources held by a business for a long period and are not expected to be consumed or converted into cash within a year. Some examples include buildings, machinery and vehicles. Fixed tangible assets are depreciated over time. Current and Long-Term Tangible Assets | Business Yield Tangible Assets Meaning. A tangible asset (TA) has monetary worth and is usually in the form of a Intangible assets, on the other hand, do not have a physical form and include items like intellectual Long-term assets, often known as fixed assets, make up the second component of the balance...

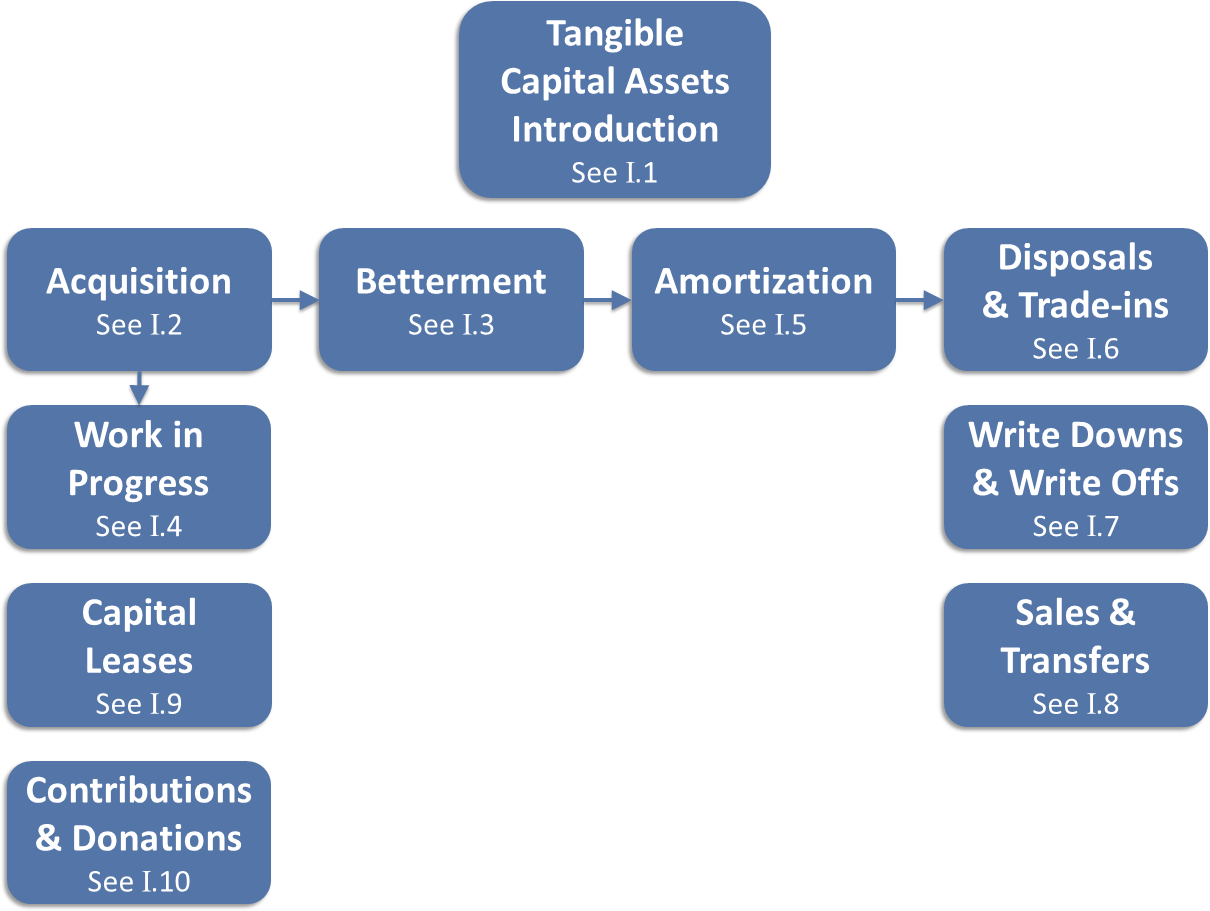

www2.gov.bc.ca › tangible-capital-assetsCPPM Procedure Chapter I: Tangible Capital Assets - Province ... For all tangible capital assets (including large EDP mainframe and LAN systems, heavy equipment, buildings, highways, bridges, etc.) that are acquired or constructed with a completion date of the first of the month or prior to the sixteenth, amortization will be taken for the current month.

Tangible Asset - an overview | ScienceDirect Topics Tangible assets, such as computers or buildings, are straightforward to calculate. Intangible assets are more challenging. Deducting long-term financing (including a large variety of financial instruments) and other liabilities yields the accounting equity value in the business.

Tangible Assets | Definition | Cost Components Tangible assets are long-lived assets which have physical existence. They are also referred to as Typical examples of tangible assets include land, land improvements, buildings, machinery, office Long-term investments are not tangible assets because even though they are non-current they do...

What are Long-Term Assets - Basic Accounting Help There are three groups of long-term assets: long-term tangible assets, such as machines and buildings; long-term intangible Thus, every year the depreciation is credited to this T-account. Technically, a T-account with a credit balance can be included on the debit side of the balance sheet.

Tangible assets - What are tangible assets? | Debitoor invoicing Tangible assets, also known as hard assets, are physical items with a clear purchase value used by a business to produce goods and services. Try free for 7 days. Examples of tangible assets include: PP&E, furniture, computers and machinery. Businesses can also have non-physical assets known as...

Tangible vs. Intangible Assets | What's the Difference? Tangible assets are physical items that add value to your business. Tangible assets include cash, land, equipment, vehicles, and inventory. Fixed assets, on the other hand, are long-term assets that cannot be converted into cash within one year. Buildings, land, and equipment are examples of fixed...

How to calculate tangible assets value | GoCardless Tangible assets examples include things like factory equipment, company vehicles, and office supplies. Computers and other electronics also qualify as tangible assets, as does any Intangible assets are considered long-term rather than current. How to calculate the value of tangible assets.

simplicable.com › new › asset5 Types of Asset - Simplicable Sep 06, 2015 · 1. Tangible Assets Tangible assets are any assets that have a physical presence. Examples include cash, stocks, bonds, property, buildings, equipment, inventory, precious metals and art.

› balance-sheet-newBalance Sheet - Long-Term Assets | AccountingCoach Intangible assets; Other assets; Here is the long-term (or noncurrent) asset section from our sample balance sheets: Investments. The first long-term asset Investments will include amounts such as the following: Long-term investments in investment securities, real estate, or other businesses; Property that is in the process of being sold

/GettyImages-923167626-1425a7c433954d43a6bd05221eb373e6.jpg)

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

:max_bytes(150000):strip_icc()/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

0 Response to "42 long-term tangible assets include"

Post a Comment